Buying property in JB 105

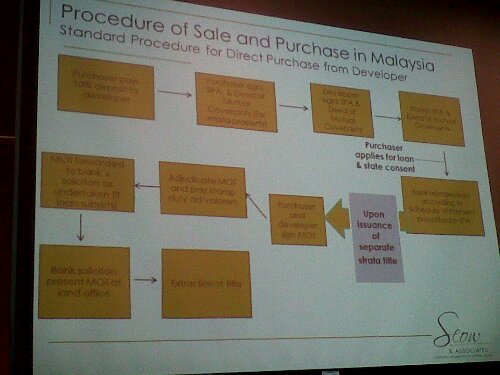

While sorting out my photographs, I came across this picture taken when I attended a PropertyGuru seminar in 2011. This was part of the slides presented by a Malaysian law firm. For those who find it difficult to make out the text, here they are. I’ve included the approximate dates so that you can have an idea of how long the process takes.

0. Purchasers books property and pays booking fee – 22 Mar 2012

1. Purchaser pays 10% deposit to developer – 21 Apr 2012

2. Purchaser signs SPA and Deed of Mutual Covenant (DMC) for strata property – 21 Apr 2012

3. Developer signs SPA and DMC – 26 Apr 2012

4. Stamp SPA and DMC

5. Purchaser applies for loan – 14 Apr 2012 and state consent – 9 Jul 2012 (approved end Aug 2012)

6. Bank releases loan according to Schedule of Payment prescribed in SPA – 17 Oct 2012

7. Upon issuance of separate strata title

8. Purchaser and developer sign MOT – 4 Jun 2012

9. Adjudicate MOT and pay stamp duty and valorem – 4 Jun 2012

10. MOT forwarded to bank’s solicitors as undertaken (if loan subsists)

11. Bank solicitors present MOT at land office – 20 Sep 2012

12. Extraction of title – 10 Oct 2012

As I look through the steps, I realised that I have gone through the whole process from signing of the SPA and DMC, application for loan and state consent, the application for MOT and finally the extraction of the land title. In whole, it took a total of 6 months to complete.

You’d notice that while all steps have to be complied with, they need not follow the order. For example, my developer wanted to transfer the land title before CF so the whole MOT process was brought forward which delayed the release of bank funds until the title was extracted.

The final step of the documentation process is of course to collect a copy of the stamped SPA, DMC, loan agreement and land title.

In terms of payment, to date the developer has filed for 45% completion which is mainly for foundation and structural works. The first 20% was paid via developer discount and cash downpayment. The bank disbursed the 15% payment on 17th October.

I was advised by the RHB loan officer that as part of the loan agreement, I will have to start paying monthly interest on whatever has been disbursed. I could also choose to begin making full monthly instalment. The difference between that and the required monthly interest would be used to pay off the principle.

It all boils down to whether we have the cash flow to start the full loan. While we can wait, it feels like a waste of money to just pay interest with no drop in the principle.

After we settle the payment schedule, all that remains would be to wait patiently for the completion of the house and then the whole process to renovate, decorate and make the place habitable.

The plan is to stay here for one year while setting it up and then to find a tenant who hopefully would pay a rent that covers at least the monthly instalment. Then we can start to save for our second investment property.

Ok this would the last instalment for the buying property in JB series.